June 2022 Portfolio Perspective

Portfolio Perspective

As of June 9th, 2022

MARKET DECLINES

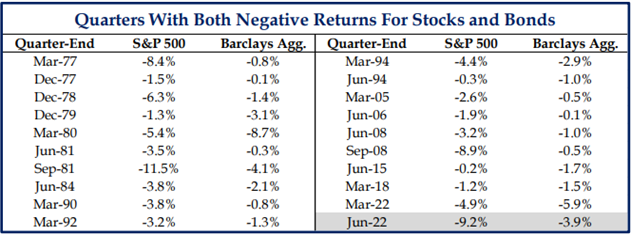

As we mentioned in the quarterly letter, experiencing declines in both bonds and stocks during a quarter is unusual (only 19x over the past 185 quarters). Looks like we are heading to another quarter of declines in both asset classes, as shown below. Consecutive quarters of declines in both stocks and bonds have only occurred 4x in the past 50 years, so it’s HIGHLY unusual.

Source: Strategas Research Partners

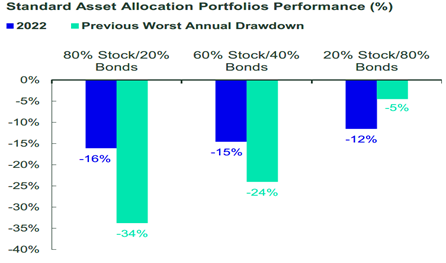

With bonds and stocks both down in 2022, we have noticed that more conservative clients seem to be more anxious. The chart below shows why: the 20/80 “conservative” allocation is down 12% YTD vs. the previous worst annual drawdown of 5%.

Source: State Street

UASI ACTIONS

Given the market declines, what is UASI doing to protect client portfolios? Here are some thoughts on the team-based flagship Growth & Income (G&I) strategy:

- In 2021, there was only one drawdown larger than 5% (5.2% was the largest), as investor sentiment was dominated by the “buy on the dip” mentality.

- As we entered 2022, we remained largely invested given that underlying fundamentals remained sound. As a result, GI was down 4.90% in 1Q versus a 4.95% decline in the S&P 500 Index (99% downside capture).

- As the G&I team became more concerned about inflation, fed policy and its impact on stock valuations, the team began to take action to reduce portfolio risk, raise cash (some from stops going off), added Gold and did some stock swaps into less volatile securities.

- As a result of these actions, the second quarter decline in G&I equates to 6.14% while the S&P 500 Index is down 9.15%. This represents a 301 basis point (BP) positive gap vs. the benchmark or just 67.1% downside capture.

- Year to date, this leaves the G&I strategy 291BP ahead of the S&P 500 with a 78.7% downside capture. The positive variance reflects a combination of +224BP from better stock/sector selection and +67BP from cash raised during the year.

Outside of G&I, a couple of noteworthy points include:

- The High Dividend and Value Plus mandates are both beating benchmarks and down less than 3% each;

- Growth Plus is beating its target benchmark by 550BP;

- The ESG strategy is currently 356BP ahead of its benchmark this year; and,

- Tactical Opportunities Plus (TOPS) is currently 413BP ahead of its benchmark