Addressing AI Bubble Concerns

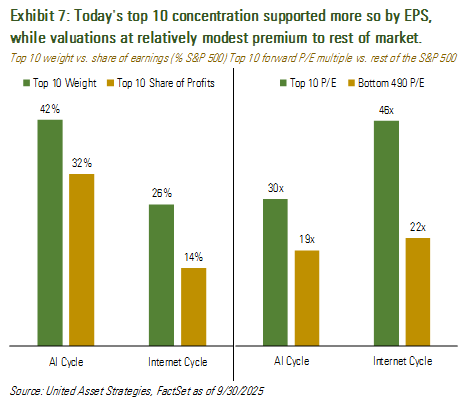

The stock market's been on a tear, driven largely by a handful of big tech names, the so-called Magnificent Seven. While we recognize that valuations are elevated and the market is highly concentrated as a result, we don't see it as bubble territory just yet. As highlighted in the exhibit shown, today's top 10 stocks make up over 40% of the overall market. While more concentrated than the internet era, the market share finds more fundamental support with today's leaders generating a third of all market profits (more than double that of the internet era leaders), and while today's top 10 trade at 30 times earnings (about 11 turns above the rest of the market), that premium reflects stronger profit margins and healthier balance sheets, and is less than half the premium assigned to the top 10 stocks in the early 2000s.

To sum it up, relative to the internet bubble, today's market finds more support in the size and quality of corporate profits. Now while we may not be in a bubble yet, it is important we stay alert to its ingredients, namely euphoria and excessive risk taking. Further, we wouldn't be surprised if this multi-year AI tailwind hits a few air pockets along the way. As a result, it is becoming increasingly important to seek diversification in a highly concentrated market that is levered to the AI theme.

For additional commentary, watch United's 3Q2025 Insights:

Commentary as of October 24th 2025. Please keep in mind this material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is intended for educational purposes only.